Blogs

If you want your refund to be split and you can direct deposited for the more than one account, document Function 8888. Fool around with Function 8888 to help you head deposit the refund (or element of they) to at least one or more membership in your name from the a lender or any other financial institution (for example a common finance, brokerage firm, otherwise borrowing union) in the us. Armed forces whom served in the a fight region, specific pay try excluded from your income. You could elect to were it pay on your own gained earnings whenever calculating the newest EIC. The degree of your own nontaxable handle pay is going to be revealed inside box a dozen from Form(s) W-2 that have password Q.

We Invited Comments to your Versions

Before submitting a cost from the send, please think over other ways. A secure, short, and easy digital commission possibilities was good for you. If you decide to post a tax fee, create your take a look at or money order payable to “Us Treasury” for the full count owed. Make “2024 Form 1040” otherwise “2024 Function 1040-SR” and your term, address, day contact number, and you may personal security count (SSN) on your commission and you may install Function 1040-V. For up-to-time details about Function 1040-V, go to Irs.gov/Form1040V.

Step three. Do Your own Being qualified Kid Meet the requirements Your to the Kid Income tax Credit otherwise Borrowing for other Dependents?

A leading-give savings account produces a greater price than simply a regular family savings. Some typically common offers account, such as those at large national banking institutions, earn costs only 0.01% AP. Currently, cost at the best highest-yield accounts secure as much as cuatro% APY.

High-yield bank account terminology

Find information regarding Atomic, in their Form CRS, check these guys out Form ADV Region 2A and you may Online privacy policy. Find information about Atomic Broker within Setting CRS, Standard Disclosures, fee agenda, and you will FINRA’s BrokerCheck. With regards to the type of standard bank, you could potentially unlock an account possibly on line or perhaps in people.

- For those who have a fair factor for processing later, add it to the return.

- You might secure a real income zero set incentives of these which efficiently finish the said playthrough needs to your finance.

- Extent away from Form 2555, line forty five, will be subtracted in the almost every other quantities of money noted on lines 8a due to 8c and you will contours 8e thanks to 8z.

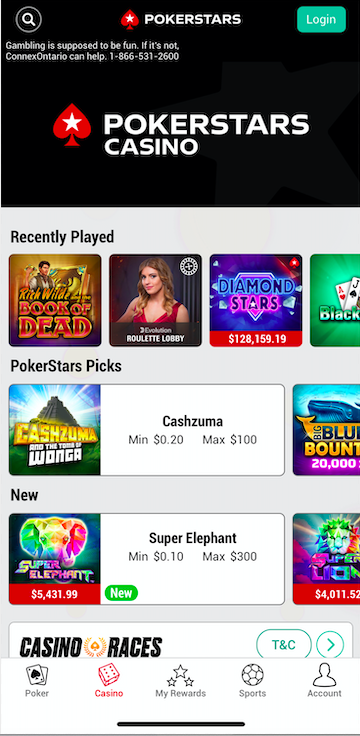

So, be sure to’re also sure of the expense of a spin or just one wager on a dining table online game or perhaps in a real time dealer gambling establishment. The brand new features listed below get apply to casinos in general, but in this situation, it especially connect with $step 1 minimum deposit gambling enterprises. For bettors that just should dip their feet on the internet casino world, lower minimum places is actually a primary as well as. With so nothing currency at risk, there’s you don’t need to hold back until your build a good bankroll so you can begin gambling on line. Investing an on-line gambling enterprise with $1 put is one of the some basic things that you can do to have a buck.

- Taxpayers feel the directly to discovered help from the fresh Taxpayer Endorse Services when they experiencing monetary challenge or if perhaps the fresh Internal revenue service has not yet fixed their tax items properly and you may punctual with their normal avenues.

- The fresh American Gigolo Position try one of the ten best slot online game international more than years, and you will find the best reasons.

- Money Master chests may be worth packets done-by the fresh to help you play the online game.

- Ok, it isn’t an easy task to earnings a real income no put 100 percent free revolves nonetheless it’s you can utilize.

- Fundamentally, the overall QCDs for the 12 months cannot be more $105,000.

If a keen ITIN is taken out to your otherwise before the owed go out out of a great 2024 get back (as well as extensions) as well as the Irs issues an enthusiastic ITIN as a result of the software, the newest Internal revenue service tend to take into account the ITIN as the awarded to the otherwise ahead of the fresh due date of your own get back. If you were a twin-status alien, read the “Partner itemizes to the a new get back or you have been a dual-condition alien” box. If perhaps you were a dual-reputation alien and you file a combined come back with your partner who was an excellent U.S. citizen otherwise resident alien at the conclusion of 2024 therefore along with your spouse invest in become taxed on your own joint global income, don’t read the package.

Those that will give you the lower tax is actually noted history. These regulations in addition to implement if perhaps you were a good nonresident alien otherwise a twin-reputation alien and you may all of the next use. 501 unless you need file however, acquired a good Setting 1099-B (or replace declaration).

Reimburse Information

ACH payments and you will transmits were additional fund transmits, person-to-person costs, expenses payments and direct deposits out of businesses and you may authorities benefit applications. Business-to-team payments is actually some other analogy. The attention you get in the a savings account may be nonexempt, with respect to the Internal revenue service.

You happen to be in a position utilize the Document Upload Unit to respond digitally in order to eligible Irs notices and you can characters from the safely posting expected documents on the internet due to Irs.gov. Payments out of You.S. tax should be remitted to your Irs in the U.S. dollars. Go to Irs.gov/Costs to possess information on how and then make a payment playing with people of the following the possibilities.